“There is no magical increase in sales from patriotic Americans willing to rescue us” – how Trump’s tariffs are stretching US amp and pedal companies to breaking point

As pedal makers told us last week, the tariffs that have been implemented by the current US administration are posing a real existential threat to the US boutique pedal industry. These choices seem to ignore the reality of the global supply chain many industries rely on, and as a result many of your favourite pedal brands are considering layoffs and closure thanks to spiralling costs and tanking sales.

READ MORE: We have delayed new product launches, or scrapped them entirely”: why boutique pedal makers fear tariffs will destroy the entire US pedal industry

Since the potential fallout of the tariffs became clear, EarthQuaker Devices CEO Julie Robbins has been raising awareness about how destructive they could be, and has also rallied a support group of concerned builders, in the absence of any official guidance.

With her help we’ve surveyed major figures from over 30 pedal, amp, guitar and pickup brands. Last week we explored how all of these figures reported negative impacts of the tariffs, from tanking sales to spiralling costs, and logistical nightmares thanks to the rapidly-fluctuating rates. This week I want to dive further into some figures to put their anxiety into a firmer context.

The cost of the tariffs

We’ve already given one direct example of a price that’s increased – JHS’ Footswitches went from around $1.10 each to around $3 per switch at their peak. Given that JHS uses around 100,000 footswitches a year, that’s potentially an extra $200,000 annually for just that single part.

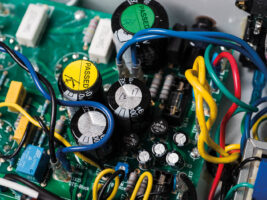

Let’s put some more numbers on things. Mission Engineering’s James Lebihan gives us the example of a PCB order, which went from $199.06 PCB in March of this year to a $314.91 order in May. That’s a pretty sizable increase by itself – however, it’s pennies compared to sourcing the same part domestically: Lebihan says Mission was quoted $9,000 for an equivalent part from a US supplier.

A few more examples: Jon Cusack of Cusack Music gives an example of a parts order that cost $5,400. The tariff charge for it was an almost 200% addition of $10,500 for a total of $15,900. Similarly, Robert Keeley reports a circuit board order for $2,000 that received a 180% tariff of $3,600. Summer School Electronics’ Mark Turley gives us an example of a parts order that went from $2,577 to $3,877. Mr Black Pedals’ Jack Deville told us of a standard footswitch that went up by $3, from $2.35 to $5.35 – and that’s a per-pedal cost increase for just a single part.

At time of writing, the tariff rate has come down since these more extreme examples were given, and are roughly 30%. This is about how much more expensive Robbins has told us EarthQuaker’s PCBs have become since March, and similar to Mission’s issues, sourcing PCBs domestically just isn’t viable.

“The quality [of US-made PCBs] is not as high, and the cost is nearly 15 to 25 times what we are currently paying,” Robbins says. “That would raise the retail price on all of our products well above a competitive range anyone would be willing to pay.”

A rock and a hard place

Even avoiding the drastic price increases that come from domestic sourcing, an increase of 30% per PCB thanks to tariffs is a significant cut into a product’s profit margin. Smaller companies with slimmer margins cannot really afford to just eat these extra costs – nor are prices of pedals flexible enough to bear price increases without seeing sales drops. There’s already an idea of what a US-made ‘boutique’ pedal in a given niche should cost, and below the likes of the $500+ workstation reverbs, these price brackets are pretty firmly-defined.

EarthQuaker’s Julie Robbins gives us the example of the FlexiLoops pedal. Launched 2024 at $129, its price includes a 15% net profit for EarthQuaker. “With the tariffs, we would need to raise the price to $159 in order to maintain a profit margin. This would overprice this product for its function.” Julie’s point is that $129 is pretty affordable compared to the rest of the EQD lineup – but the FlexiLoops is ultimately a loop-switcher. The tariffs could push this utility pedal up to the kind of price people are used to paying for fully-featured effects pedals.

These makers are also acutely aware of the wider economy at the moment – people are being squeezed on the cost of everyday items across the board, leaving everyone with less disposable income. If boutique pedal makers were to increase their prices significantly to cover the tariff costs, many of them feared that this would lead to a drastic sales drop – which could lead to layoffs or outright closure.

And this is on top of the fact that many have already seen sales collapse since the tariffs came in. Export sales in particular have fallen the worst for many companies – one maker even lost a European dealer who didn’t want to risk products getting caught up in an escalating trade war.

EveAnna Manley of Manley Laboratories described the impact of the tariffs being coupled with an “anti-American poisoning of the customer sentiment in other countries,” thanks to the measures themselves and the confrontational tone with which they’ve been implemented. “The destruction of our heretofore healthy export business is much more of a problem than increased tariffs on incoming parts for my particular company,” she says, adding that “there is no magical 100% increase in domestic sales relief coming from patriotic Americans willing to rescue us boutique, made-in-USA companies, either.”

The future

We asked brands what the impact of the tariffs might be in the next six to 12 months if things don’t change. The outlooks they set out here are universally negative, with many emphasising the inevitable outcome of falling sales from increased prices – leading to anything from fully outsourcing manufacturing, mass layoffs and closure – a number of companies’ answers here are simply ‘failure’ or ‘closure’.

JHS’s Josh Scott tells us that “prices will rise, sales will drop due to that – and we may be facing mass layoffs by 2026 in a worst case scenario.” Robert Keeley similarly states that “the current tariff level will zero out my chance for a profitable year. A 55% tariff on half of my cost going into producing a product is not sustainable.”

Mission Engineering’s James Lebihan states: “We have frozen hiring and expansion plans. We are looking into outsourcing our product assembly. If the situation does not improve we will begin laying off US staff and look to relocate to a small factory or shut down our manufacturing completely and outsource everything. It’s possible we may not be able to continue and the business may close completely.”

Jon Cusack writes of the unique challenges that his company faces thanks to Cusack Music’s business model. “Since I manufacture for many other brands in the industry, I fear that this may force some of them into outsourcing their entire builds to China… we could lose between five and perhaps all 30 of my employees if it gets bad enough.”

One other potential impact that Death By Audio’s Oliver Ackermann raises is a shift away from the experimental pedals to focus on the mass-appeal stuff with guaranteed sales. This is one of those more intangible things that still ultimately undermines the industry, given that up until now, the US boutique pedal market has been one that allowed fiercely creative and experimental products to find a niche.

Phone home

Electronics are, of course, one of the central issues of the tariff debate – so amp and pedal companies are going to be locked into this fight no matter what. Trump’s attention is focused on threatening the larger smartphone makers and trying to prove that a USA-made phone is totally possible, and so even if guitar-makers avoid the full force of the tariffs on wood imports, the electronic components that are 90% of a pedal’s bill of materials are going to remain in the crossfire.

Last week we explored how the tariffs are ostensibly trying to bolster a domestic electronics industry that does not exist. The furore about the Trump Phone has become the most high-profile facet of this – with experts casting huge doubts on the claim that an entirely US-made phone is going to be launched in August for $499.

The global supply chain has been an essential cog of American manufacturing and commerce for decades now. Even the President himself leverages it for his own business interests – be that red hats, Trump Guitars or indeed a phone.

As we’ve discussed, there simply aren’t viable sources of US-made resistors or capacitors in 2025. Even the biggest companies in the world cannot just create a US electronics industry out of whole cloth. Apple cannot instantly magic a component factory out of the ground in Ohio – and the tariffs are in force and strangling small businesses in America right now. Without some sort of exemption, what hope is there for this industry in the short to medium term, even if every resource is moved in the next few years to make all-American electronics possible someday?

Until this nebulous and entirely speculative future comes to pass, sales are down, costs are up, the future is uncertain. What viable paths out from this situation are there? Makers are trapped between these ever-increasing costs, decreasing margins and the impossibility of domestic sourcing.

Tooling up to make the parts needed, according to multiple makers that we surveyed, comes with an estimated cost ranging from hundreds of millions of dollars to several billion and a time scale of, at the very least, five years, but most likely more.

Will the American pedal industry exist by then? We all hope so, but the situation is looking increasingly dire.

The post “There is no magical increase in sales from patriotic Americans willing to rescue us” – how Trump’s tariffs are stretching US amp and pedal companies to breaking point appeared first on Guitar.com | All Things Guitar.

Source: www.guitar-bass.net